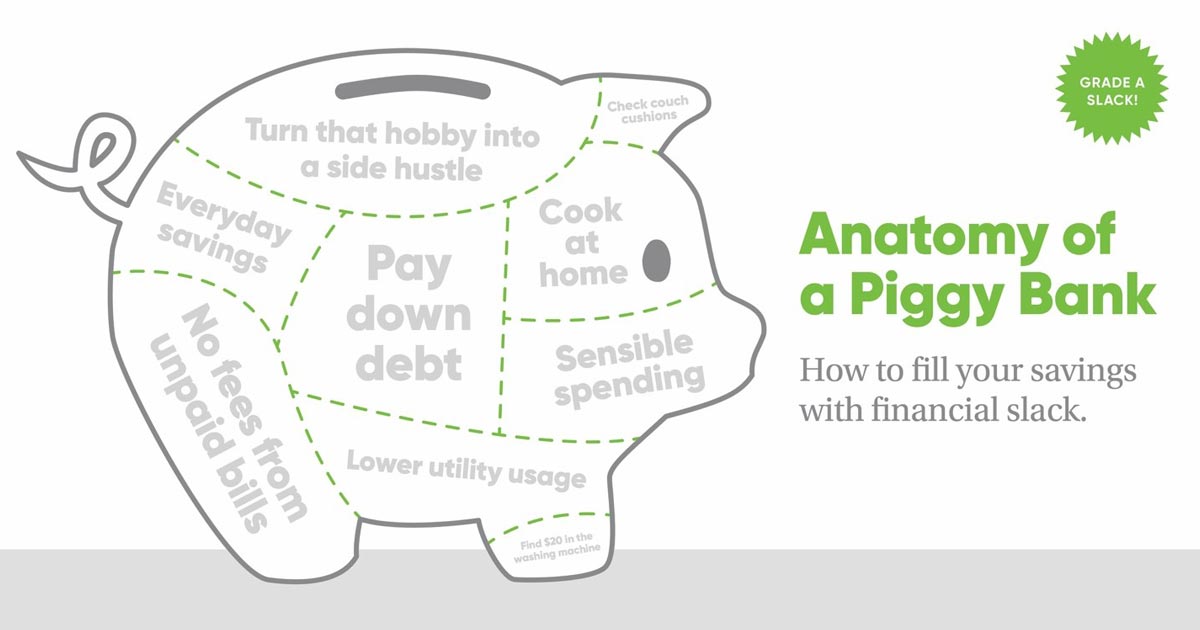

Fill Your Savings with Financial Slack

Grade A slack tips to fill your piggy bank to the brim.

What goes into saving money? A lot. But if you cut it down into small action items, it’s a lot more doable. Here we share some ways to create financial slack and fill your savings.

Being thoughtful about where you’re spending your money helps you stay aware of what is most important to you. This keeps you from spending impulsively on unnecessary items.

Setting up automatic savings to “pay your piggy bank” is a great way to make sure you’re putting a little away every day. You can start with just $5 at first just to get you going. You can accomplish this by setting up automatic transfers to your accounts or by directing a little bit of your direct deposit from your paycheck into your savings account.

We all have our own various talents. If there is something you’re good at and enjoy doing outside of your regular job maybe it is something you can make money on. Some examples of things we’ve seen be successful are making crafts, reselling items found at estate sales and baking.

We may joke about checking the couch cushions or finding $20 in the washing machine, but money is money. Put that in your savings. A more popular way to find money in our current era of technology is by checking those apps you use to transfer money to friends and family like Venmo, PayPal and Apply Pay. I love it when I realize someone paid me back for something and I just have money sitting in there. Don’t spend it or transfer it to your checking account. Move that money into your savings.

Cooking at home more helps increase your financial slack and puts you in control of what how much you want to spend enjoying a meal. You can also look at ways to lower utility usage. Are you turning off all the lights when you leave? Does the a/c or heater run too much when you’re not home? There are various things around the house you can do to put more financial slack back in your savings account.

All of these examples are just ways to help you get started. Our Financial Health Centers specialize in helping people build and maintain financial slack. We’re here to support you in setting savings goals and making a plan to reach them.