Improve Your Credit Before Buying A Home

A crucial part of the homebuying process is ensuring your credit score meets the requirements lenders look for. A higher credit score can help you secure better mortgage rates and terms, saving you money.

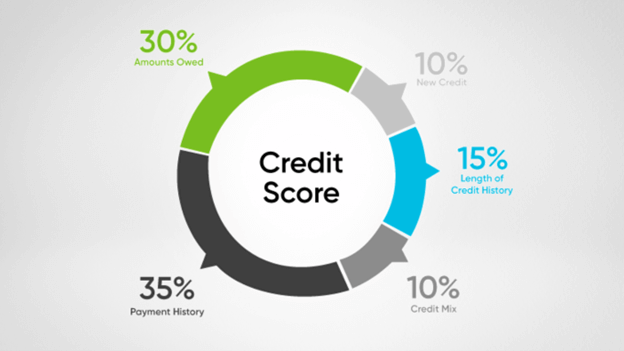

Your credit score is determined by five key factors: payment history, amounts owed, length of credit history, new credit and credit mix. While each of these factors are important, they do not impact your score equally. Because of this, you can boost your score faster by being strategic about which areas of your finances you choose to focus on first. Keep reading to learn what actions you can take to improve your credit score before you buy a home.

1. Check Your Credit Report

Start by obtaining a copy of your credit report. You can request a free one here. Most lenders require a credit score of at least 620 for approval on a home loan. Take note of your score and look for any errors or discrepancies in your report as these could be negatively impacting it. If you find any inaccuracies, dispute them promptly.

2. Pay Down Outstanding Debts

Your credit utilization ratio, which is the amount of credit you're using compared to your credit limit, plays a significant role in your credit score. Aim to keep your credit utilization below 30%. If you have credit card debt(s) you are ready to tackle, learn what strategies are proven to help do so effectively. It’s important to tackle unmanageable credit card debt before applying for a loan.

Related reading: Proven Strategies for Successful Debt Repayment

3. Make Timely Payments

Payment history is one of the most critical factors in your credit score. You want to show lenders that you pay all your bills on time, every time. If you often forget to make your payments before their due dates, set up automatic payments or reminders to help you stay on track. If you’re a Credit Human member, you can set these up in your account in digital banking.

4. Avoid Opening New Credit Accounts

While it might be tempting to open new credit accounts to increase your available credit, doing so can temporarily lower your credit score. Each new credit inquiry can have a small negative impact, so it's best to avoid opening new accounts in the months leading up to your home purchase.

5. Keep Old Accounts Open

The length of your credit history also affects your credit score. Keeping older accounts open, even if you don't use them frequently, can help maintain a longer credit history and improve your score.

6. Diversify Your Credit Mix

Having a mix of different types of credit, such as credit cards and auto loans can positively impact your credit score. However, don't take on new debt just for the sake of diversifying your credit mix.

7. Monitor Your Credit Regularly

Regularly monitoring your credit can help you stay aware of any changes and address potential issues promptly. As a Credit Human member, you have access to regular credit checks and other financial health tools that make monitoring your finances easier.

A higher credit score can open doors to better loan offers, making your dream of homeownership more affordable. At Credit Human, we're here to support you every step of the way. For personalized guidance, click here to locate your nearest Financial Health Center.